Acquire Vs Rent: Comprehending the Benefits And Drawbacks of Residing In an Apartment

The decision to purchase or rent an apartment involves cautious consideration of various elements. Each option provides distinct benefits and negative aspects that can considerably affect one's financial scenario and lifestyle. Buyers typically deal with huge ahead of time prices and ongoing upkeep responsibilities, while renters delight in versatility and lower first investments. As people consider these aspects, understanding the subtleties of each option becomes crucial. What elements ultimately influence the choice between these 2 paths?

The Financial Aspects of Getting an Apartment

When considering the purchase of an apartment, possible purchasers should thoroughly examine the financial ramifications entailed. The preliminary expenses can be significant, including the deposit, shutting expenses, and numerous costs associated with evaluations and appraisals. Buyers must additionally consider continuous expenses such as real estate tax, homeowners' association (HOA) costs, insurance, and maintenance costs.Financing alternatives play an essential role in the total cost of the house. apartments in glen carbon il. Passion prices, funding terms, and credit history ratings can greatly influence monthly home loan payments. In addition, potential customers must think about the lasting financial investment worth of the building, as genuine estate can value with time, supplying financial advantages in the future.Ultimately, extensive research and monetary preparation are fundamental for making a notified choice regarding buying an apartment. Customers must evaluate the possible returns versus their financial security and individual conditions to guarantee an audio investment

The Financial Ramifications of Renting

The monetary ramifications of leasing include month-to-month rental prices, which can rise and fall based on area and market conditions. Occupants likewise birth much less obligation for maintenance expenses, as these usually drop on the proprietor. Nevertheless, the lack of long-lasting economic dedication can impact one's capability to build equity with time.

Regular Monthly Rent Prices

Although lots of individuals are attracted to the versatility that leasing deals, the monetary effects of month-to-month rental fee expenses can considerably impact their budget plans. Rent generally represents a significant part of a lessee's regular monthly costs, commonly ranging from 25% to 50% of their income. This variability depends on variables such as location, building dimension, and features. Additionally, rent payments are needed consistently, making it vital for tenants to keep a stable revenue to prevent economic pressure. Unlike home mortgage repayments, which construct equity over time, rental fee payments do not add to property build-up. Consequently, prospective occupants should meticulously examine their financial circumstances and consider exactly how month-to-month rent prices will fit into their total budget plan before committing to a rental contract.

Maintenance Expenditures Obligation

While occupants take pleasure in the advantage of not having to stress over lots of upkeep jobs, they might still deal with significant financial ramifications pertaining to duty for upkeep. Normally, property managers are responsible for major fixings and maintenance, which eases some costs for tenants. Lessees might be responsible for minor repair services, such as changing light bulbs or taking care of a leaking faucet. Additionally, unforeseen expenses can occur from problems like pipes or electric failures, which might lead to raised economic problem otherwise covered by the lease contract. Tenants ought to additionally consider the potential for rental fee boosts to cover upkeep costs. Subsequently, while upkeep responsibilities are largely changed to landlords, occupants should remain aware of their commitments and possible expenses that can arise throughout their lease term.

Long-lasting Monetary Commitment

Financial security often hinges on the decision in between leasing and buying an apartment, particularly when taking into consideration the long-lasting commitments connected with each option. Renting might appear economically adaptable, allowing people to relocate conveniently and avoid substantial deposits. Nevertheless, it can cause ongoing regular monthly expenses without developing equity. Occupants undergo annual lease increases, which can strain budgets with time - luxury apartments for rent edwardsville il. Furthermore, the absence of ownership suggests that rental payments do not contribute to long-term riches accumulation. On the other hand, purchasing an apartment generally involves a considerable in advance financial investment yet provides the potential for building worth gratitude. Eventually, the option in between leasing and getting requires mindful assessment of one's economic objectives and long-term security

Security vs. Adaptability: Which Is Right for You?

When thinking about apartment living, people usually evaluate the benefits of security against the demand for adaptability. Long-lasting commitments, such as purchasing a home, can give protection yet may restrict wheelchair and adaptability. On the other hand, leasing permits greater liberty to transfer, dealing with those whose conditions might transform regularly.

Lasting Commitment

Selecting in between buying and renting out an apartment commonly rests on the individual's need for stability versus their need for versatility. A long-term dedication to buying typically suggests an intention to work out in one area, promoting a sense of durability. Homeownership usually comes with monetary advantages, such as equity building and possible gratitude in home value, contributing to long-lasting safety. Conversely, renting enables for greater flexibility, enabling individuals to alter their living scenario based on life situations or preferences. Renters may like this alternative during transforming periods, such as work modifications or individual growth. Eventually, the choice between a long-term commitment to ownership or the flexibility of renting mirrors personal priorities and future goals, substantially influencing one's way of living and financial preparation.

Movement and Flexibility

The decision to buy or rent an apartment considerably affects an individual's movement and versatility in life. Homeownership generally supplies security but can restrict flexibility due to the long-term economic dedication and initiative needed to sell a residential property. Alternatively, renting permits higher movement, making it possible for people to relocate conveniently for work opportunities or way of life modifications without the concern of offering a home. This versatility can be especially helpful for those in shifting stages of life, such as students or young experts. While international real estate renting can bring about a lack of durability, it gives the flexibility to check out different areas and cities. Eventually, the option in between purchasing and leasing rest on personal priorities-- security versus the demand for adaptability in an ever-changing world.

Upkeep Obligations: Homeownership vs. Renting out

While homeownership frequently brings the attraction of freedom, it also features a substantial worry of upkeep responsibilities that occupants typically prevent. Homeowners have to take care of repair services, landscape design, and regular upkeep, which can be both time-consuming and pricey. This consists of resolving pipes problems, roofing fixings, and home appliance breakdowns, every one of which can add stress to the home owner's life.In comparison, tenants generally take advantage of a more hands-off method to upkeep. Property supervisors or property owners handle repair services and upkeep jobs, allowing occupants to concentrate on their living experience as opposed to residential or commercial property care. This division of obligations can be particularly appealing for those who focus on flexibility and simplicity in their living arrangements.Ultimately, the selection in between purchasing and leasing click for more info depend upon one's readiness to take on upkeep tasks, with homeownership demanding a commitment that several renters may like to avoid.

Investment Potential: Acquiring an Apartment

Purchasing an apartment can offer substantial monetary benefits over time. As property worths generally appreciate, home owners might see their financial investment grow significantly, generating a rewarding return when offering. Furthermore, owning an apartment provides a hedge against inflation, as mortgage repayments stay steady while rental prices may increase. The potential for rental earnings includes another layer of monetary advantage; owners can rent out their devices, generating passive income that can balance out home mortgage expenses and add to overall riches accumulation.Furthermore, tax advantages often come with home ownership, consisting of reductions for home mortgage passion and real estate tax. These financial rewards improve the good looks of acquiring an apartment as a financial investment. Nevertheless, possible investors ought to likewise consider market changes and linked possession costs, such as upkeep and organization costs. A thorough evaluation of these aspects can help identify if buying an apartment straightens with a person's monetary goals and take the chance of resistance.

Way Of Living Factors To Consider: Amenities and Area

Choosing the ideal home involves cautious factor to consider of lifestyle elements, specifically facilities and place. Lots of people focus on facilities that enhance their living experience, such as gym, pools, or public spaces. These facilities can significantly affect everyday routines and social communications, making home life extra enjoyable.Location is equally important; distance to work, institutions, purchasing, and public transportation influences convenience and general lifestyle. Urban residents might favor apartments in bustling areas, while those seeking peace might favor suv setups. Furthermore, safety and neighborhood ambiance play essential duties in figuring out a perfect location.Ultimately, the best mix of services and area can produce a harmonious living atmosphere that lines up with individual preferences and way of living requirements. Each individual's top priorities will differ, making it imperative to assess these variables meticulously prior to making a decision about purchasing or renting real estate offices in the area an apartment.

Long-term vs. Short-term Living Plans

The choice between lasting and temporary living plans considerably impacts one's home experience. Lasting services generally offer stability, permitting lessees to establish roots in an area. This security commonly leads to a deeper understanding of regional amenities, social connections, and individual comfort. Furthermore, lasting leases might offer lower monthly rates compared to temporary options, which are commonly extra costly as a result of flexibility.Conversely, temporary plans interest those looking for movement or temporary housing services. This adaptability can be useful for individuals exploring brand-new cities, traveling for work, or examining. Temporary rentals typically lack the sense of permanence and might involve frequent relocations.Ultimately, the selection between long-lasting and short-term living depends on private scenarios, priorities, and way of life preferences. Mindful factor to consider of these variables can lead to a more enjoyable house experience, tailored to one's details demands.

Frequently Asked Inquiries

Just How Do Residential Or Commercial Property Tax Obligations Impact House Ownership Expenses?

Real estate tax considerably influence the general prices of apartment possession. Higher tax obligations can increase month-to-month expenses, influencing budgeting. Additionally, varying tax obligation rates might influence property worths, making ownership less economically advantageous in certain markets.

What Are Regular Lease Lengths for Rental Homes?

Common lease sizes for rental apartment or condos normally range from 6 months to one year. Some property owners may supply month-to-month options, while longer leases of two years or even more can additionally be worked out depending upon tenant needs.

Can I Bargain My Rent Price With Landlords?

Negotiating rental fee prices with property managers is commonly possible, depending on market conditions and the landlord's flexibility. Potential occupants need to prepare to present their instance, highlighting factors for arrangement to boost their opportunities of success.

What Takes place if I Need to Break a Rental Lease?

When a renter needs to damage a rental lease, they might incur charges, waive their down payment, or face legal consequences. It's vital to review the lease terms and communicate with the property manager quickly.

Exist Hidden Charges When Acquiring an Apartment?

When purchasing an apartment, potential covert charges might include shutting costs, maintenance charges, real estate tax, and house owners association fees. Buyers must completely evaluate all economic aspects to prevent unforeseen costs post-purchase.

Jennifer Grey Then & Now!

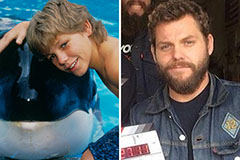

Jennifer Grey Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!